santa clara property tax rate 2021

Santa Clara Valley Water District North Central Zone. Property Taxes are made up of.

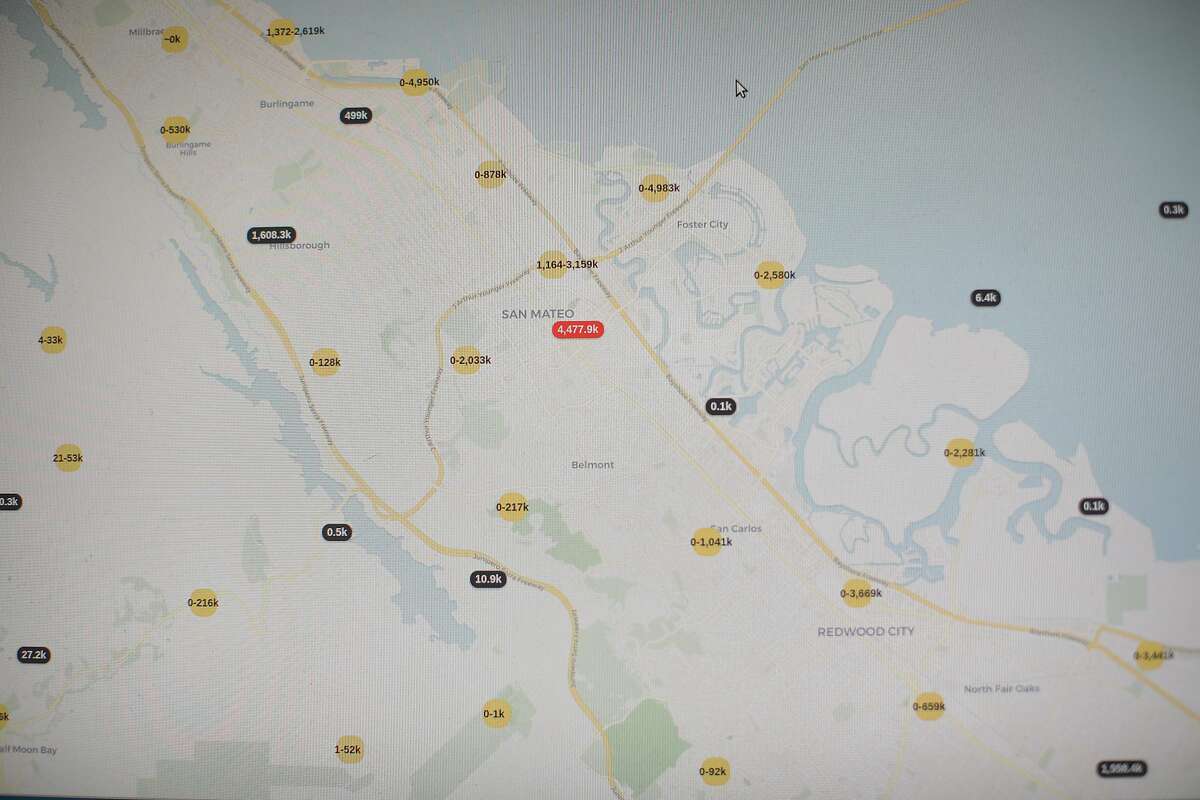

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Santa Barbara campus rate.

. The bills will be available online to be viewedpaid on the. The bills will be available online to be viewedpaid on the. Elements of Property Taxes.

067 of home value Yearly median tax in Santa Clara County The median property tax in Santa Clara. The minimum combined 2022 sales tax rate for Santa Clara California is. 1 assessed-value property tax.

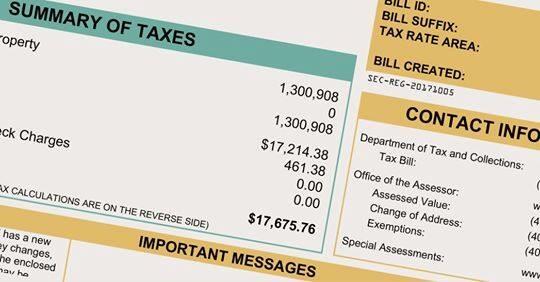

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Santa Clara County California Property Tax Go To Different County 469400 Avg. 1788 rows Santa Clara.

The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. 067 of home value Yearly median tax in Santa Clara County The median property tax in Santa Clara. The chart shows the Countywide distribution of the 1.

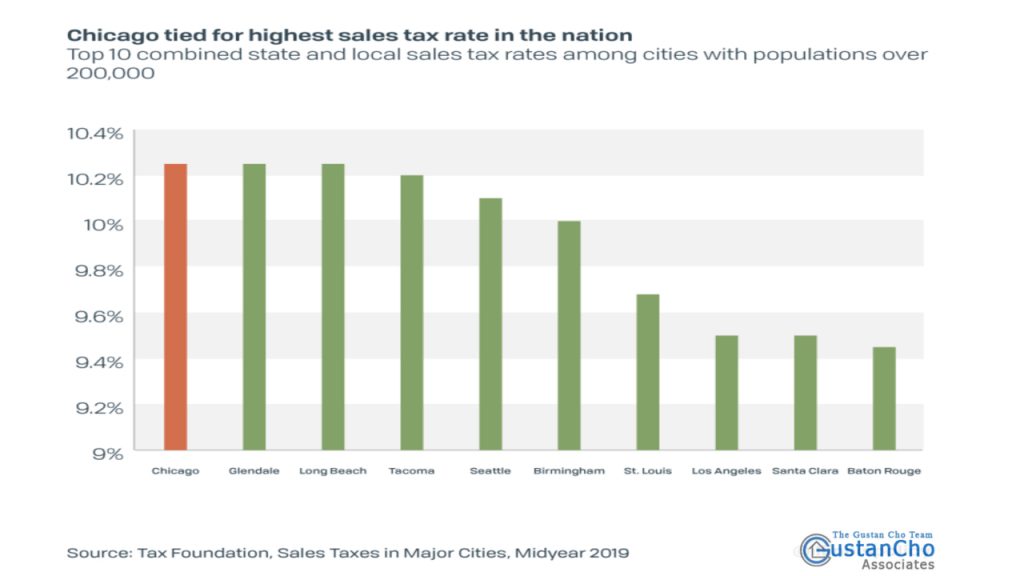

Santa Clara County has one of the highest median property taxes in the United States. Higher sales tax than 75 of California localities 0375 lower than the maximum sales tax in CA The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate.

What is the sales tax rate in Santa Clara California. The median property tax in Santa Clara County California is. The average effective property tax rate in Santa Clara County is 073.

This is the total of state county and city sales tax rates. Yearly median tax in Santa Clara County. Santa Clara County California Property Tax Go To Different County 469400 Avg.

County of Santa Clara Department of tax collections. SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The bills will be available online to be viewedpaid on the same day. This report shows the allocation of property tax in Santa Clara County for your tax rate area. Search Unclaimed Monies Property Tax Refunds.

Effective April 1 2021 Proposition 19 permits eligible homeowners defined as over 55 severely disabled or whose homes were destroyed by wildfire or disaster to transfer their primary. As of June 18 2021 the internet website of the California Department. September 2021 Publication - Notice of Tax Defaulted Delinquent.

Reminder First Installment Of 2018 2019 Property Taxes Due Nov 1 County Of Santa Clara Mdash Nextdoor Nextdoor

California Sales Tax Rates By City County 2022

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

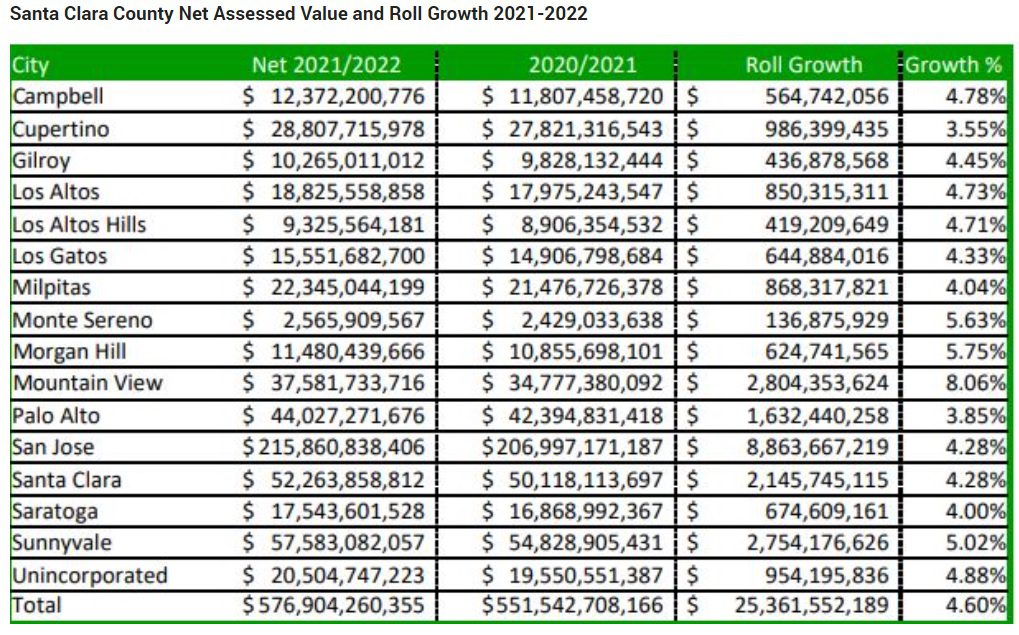

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Assessor Santa Clara County California Primary Election Ballot Voter Guide Tuesday June 7 2022 Voter S Edge California Voter Guide

Santa Clara County Library District Wikipedia

Property Taxes Department Of Tax And Collections County Of Santa Clara

State And Local Sales Tax Rates In 2017 Tax Foundation

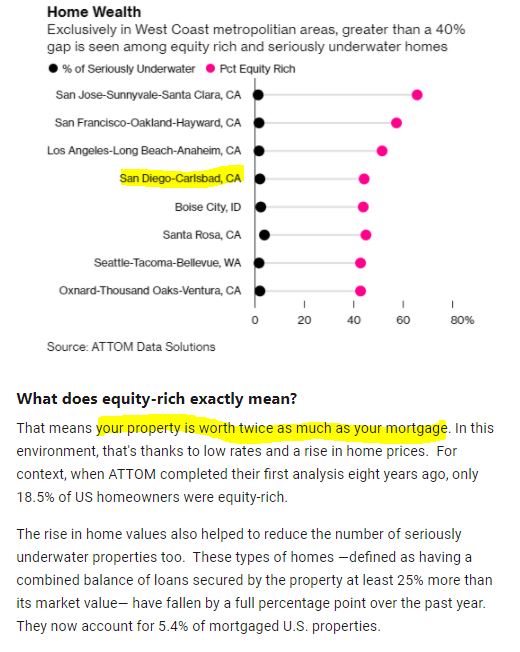

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Home Prices Market Conditions Compass

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa